special tax notice principal

The 24-month average segment rates. Or if your payment is from a designated Roth account to a Roth IRA or designated Roth account in an employer plan.

This notice summarizes only the federal not state or local tax rules that might apply to your payment.

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

. The subject matter in this communication is educational only and provided with the understanding that Principal is not rendering legal accounting investment advice or tax advice. Principal Life Insurance Company lawsuit would be eligible to be rolled over to an IRA or an employer plan. Updates for the corporate bond weighted average interest rate for plan years beginning November 2021.

August 23 2019 - Real Estate Debt Income Fund Return of Capital. After-tax Contributions and Roth 401k plan deferrals1 After-taxrollover into an IRA. This Special Notice provides guidance on determining the Washington taxable estate of a decedent whose ownership interests in business entities hold real property.

The Plan Administrator will assist you in identifying how much of your payment is the taxable portion and how much is the after-tax portion. While the Tax Code allows plans to create their. As an alternative you can use the self-billing procedure described in paragraph 1741 if you meet the conditions set out in Self billing VAT Notice 70062 the customers registered for VAT.

Review this retirement plan participant notice summary PDF to make sure you know which notices to send and the timing requirements. Every year my Property Tax statement shows a special assessment principal value and a special assessment interest value on it. The rules described in this notice are complex and contain many conditions and exceptions that are not included in this notice.

Therefore you may want to consult with the plan administrator an ey financial planner or a professional tax. Designated Roth account a type of account in some employer plans that is subject to special tax rules. Get your tax forms online.

The Special Tax Notice Regarding Plan Payments below for more information. In addition if the Plan holds S corporation. August 31 2019 - Global Multi-Strategy Fund Return of Capital.

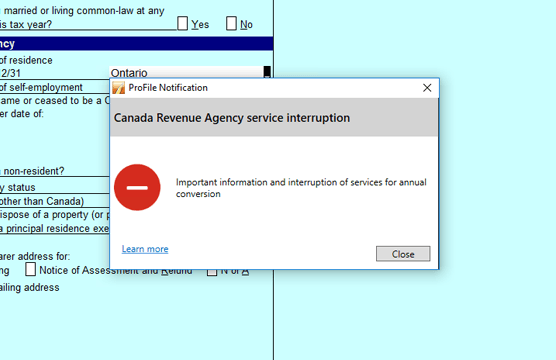

Part II of this notice describes the rollover rules that apply to payments from the Plan that are from a. This notice is intended to help you decide whether to do such a rollover. 402f SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS YOUR ROLLOVER OPTIONS You are receiving this notice because all or a portion of a payment you may be eligible to receive from the Class Action Settlement in the Anderson v.

Usually it is included along with the distribution form. For example the payments could be paid to you annually semi-annually quarterly. Our neighborhood was assessed for sewer water and street repairmaintenance and told we could pay the assessment off over a 10 year period with interest.

You may roll over your after-tax contributions to an IRA either directly or indirectly. Its faster and you can skip the paper. Notice 2021-62 2021-49 IRB.

Review this guide to electronic notice delivery PDF to understand if. Are eligible to receive from the Plan is eligible to be rolled over to an IRA or an employer plan or because all or a portion of your payment is eligible to. This notice does not describe local income tax rules or the rules for other states.

SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS. The funding transitional segment rates applicable for November 2021 and the minimum present value transitional rates for October 2021. Installment Payments Defined - installment payments are payments distributed to you in any amount you choose at intervals that you determine within limits set by the trustee or custodian.

12218 ESOP dividends and amounts treated as distributed because of a prohibited allocation of S corporation stock under an ESOP. SPECIAL TAX NOTICE REGARDING YOUR ROLLOVER OPTIONS You are receiving this notice because all or a portion of a payment you are receiving from the Retirement Systems of Alabama the Plan is eligible to be rolled over to an IRA or an employer plan. 5 You are receiving this notice because all or a portion of a payment that you.

The payment you. Or if your payment is from a designated Roth account to a Roth IRA or designated Roth account in an employer plan. If you are employed by a new employer that has an eligibleemployer plan such as a 401K a 403b tax-sheltered annuity or a governmental 457b plan you may want a direct rollover to tha plant.

SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS This notice explains how you can continue to defer federal income tax on your retirementsavings in the INSERT NAME OF PLAN the Plan and contains important information youwill need before you. Is either of these deductible and where is this addressed in Turbo Tax Deluxe. This notice describes the rollover rules that apply to payments from the Plan that are not from a designated Roth account a type of account with special tax rules in some employer plans.

SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS ROLLOVER OPTIONS Page 1 of 5 Start. You should consult with appropriate counsel or other advisors on all matters pertaining to. Washington estate tax is imposed on every transfer of property located in Washington.

There are 3 things you can do to improve participant notice delivery for your organizations defined contribution retirement plan. December 20 2019 - Global Opportunities Fund Acquisition. SPECIAL TAX NOTICE REGARDING RETIREMENT PLAN PAYMENTS v.

The Special Tax Notice also called a Rollover Notice or 402f Notice must be furnished to plan participants any time all or a part of a distribution is eligible for rollover. This notice is intended to help you decide whether to do such a rollover. However if you do a rollover you will not have to pay tax until you receive payments later and the 10 additional income tax will not apply if those payments are made after you are age 59-12 or if an exception to the 10 additional income tax applies.

You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA or an employer plan. October 11 2019 - LargeCap Growth Fund Acquisition. You are receivingthis notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA or an employer plan.

Special Tax Notice Fact Sheet 20 Page 2 of 3 120 Direct rollover to a qualified plan. Part I of this notice describes the rollover rules that apply to payments from the Plan that are not from a. That means the Notice doesnt have to be provided until the participant elects a distribution.

If the Plan is an Employee Stock Ownership Plan dividends paid to you from the Plan cannot be rolled over. Contact the plan administrator. The Department of Revenue administers the Washington estate tax Chapter 83100 RCW.

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

T2 Corporate Tax Preparation Cra Efile Software Profile

Filing The T3 Tax Return Advisor S Edge

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

Potential Tax Implications From Renting A Principal Residence Advisor S Edge

Wasauksing Kinomaugewgamik Wasauksing First Nation

Federal Budget Tax Changes 2022 Canada

Business Activity Code For Taxes Fundsnet

/MunicipalBondTipsfortheSeries7Exam3-0172a9bddeea4d0f9ab3426044d08b6a.png)

Municipal Bond Tips For The Series 7 Exam

Understanding Key Documents When Investing In A Rrsp Fonds Ftq

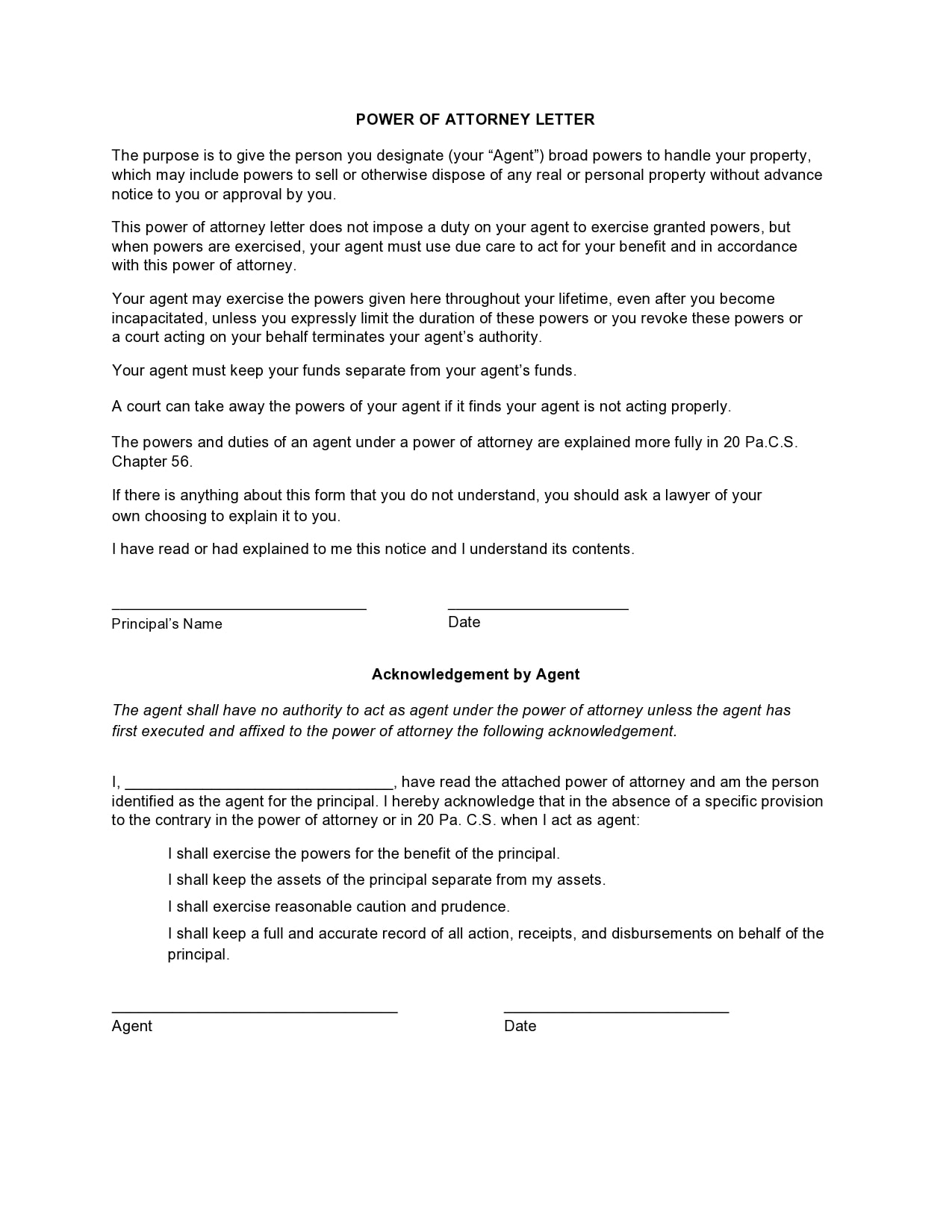

27 Professional Power Of Attorney Letters Examples

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)