Ontario staycation tax credit

Introducing the Ontario Staycation Tax Credit The government is proposing a new temporary Ontario Staycation Tax Credit for the 2022 tax year. Eligible expenses include leisure trips at a location such as a hotel bed-and-breakfast or resort in Ontario.

Staycation Report 2021 Staycations Set To Stay As The Continued Travel Trend For 2022 Traveldailynews International

Fighting Financial Crimes and Tax Evasion.

. Ontario Staycation Tax Credit aims to get people exploring at home. Ontario Staycation Tax Credit. Seniors Home Safety Tax Credit.

According to the government the temporary tax credit would give travellers support by. Also coming into effect in 2022 the new Staycation Tax CreditOntario residents can apply for a refundable credit of up to 20 per cent or. The staycation tax credit was announced in Ontarios economic statement for 2021 where the provincial government also proposed the extension of another credit that could continue to help with job training programs.

Northern Ontario Energy Credit. Staycation tax credit welcome by Jason Bain November 22 2021 Outdoors tourism operators welcome the provinces planned staycation tax credit. Enhancing Assessment Accuracy and Stability.

Anyone planning a getaway within the province in the 2022 tax year could be eligible under the new Ontario Staycation. Introduction of the Ontario Staycation Tax Credit. It will give Ontarians 20 off accommodations in Ontario up to 1000 for individuals and 2000 for families for a.

This Personal Income Tax PIT credit would provide Ontario residents with support of 20 per cent of eligible 2022 accommodation expenses of up to 1000 for an individual and 2000 for a family for a maximum credit of 200 or 400. Dec 10 2021 December 10 2021. A new temporary staycation tax credit will allow Ontarians to claim up to 1000 for individuals or 2000 for families on 2022 holiday rental accommodations.

ONTARIO STAYCATION TAX CREDIT FOR ONTARIO RESIDENTS. Feed Ontario said more than 590000 people in the province accessed food banks over the course of a year. The Ontario Staycation Tax Credit first announced in November offers a maximum credit of 200 to individuals and 400 to families in an.

This Personal Income Tax PIT credit would provide Ontario residents with support of 20 per cent of eligible 2022 accommodation expenses of up to 1000 for an individual and 2000 for a family for a. We realize that your pets are part of the family and thats why weve made Pine. The Ontario government is helping seniors stay in their homes longer by extending the Seniors Home Safety Tax Credit by one year to 2022.

Author of the article. Staycation tax credit Ontarios staycation tax credit comes into effect on Jan. 1 and will last for the duration of 2022.

Ontarians could get 20 per cent personal income tax credit on eligible accommodations between January 1 and December 31 2022 up to a maximum claim of 1000 per individual or 2000 for a family unit for a maximum credit of 200 or 400 respectively. Can you think of a better way of spending Christmas holidays with your partner than holding hands and walking under a million lights or. Introducing the Ontario Staycation Tax Credit.

Ontario Staycation Tax Credit. Ontario Staycation Tax Credit. The onetime Staycation tax credit for the 2022 tax year.

Then Upper Canada Village may be the place to be. The Ontario government has announced its plan for a staycation tax credit. The three credits listed below are based on information reported on your previous years income tax return.

The Seniors Home Safety Tax Credit is a refundable credit worth 25 per cent of up to 10000 per household in eligible expenses to a maximum credit of 2500. Extending the Ontario Seniors Home Safety Tax Credit. The program was announced as part of the Doug Ford governments Fall.

What you can expect from the Ontario Staycation Tax Credit. Find out who is eligible. The credit would provide an estimated 270 million to support over one-and-a-half million families to further discover Ontario.

A new Ontario staycation tax credit could give residents a refund on a portion of their travel expenses so long as they stay within the province. The refundable credit will apply to 2022 personal income tax returns and be a maximum of 200 for an individual or 400 for a family. Feed Ontario released its 2021 Hunger Report recently and it shows food bank usage is soaring in the province.

Property Tax Stability and Competitiveness. Plan Your 2022 Vacation in the Province and You Could Save Up to 400. Ontario Sales Tax Credit.

COVID19 MESSAGE TO OUR GUESTS 2021. Officials said this is the largest single-year. Extending the Ontario Jobs Training Tax Credit.

Residents can get a maximum credit of 200 individual or 400 for a family when they spend 1000 or 2000 respectively in accommodation expenses in Ontario. There is a maximum credit of 200 for an individual or 400 for a family. Ontario residents can receive a 20 tax credit for local accommodation expenses.

The Ontario Jobs Training Credit could refund eligible individuals half of the appropriate expenses for the year up to 2000. The government is proposing a new temporary Ontario Staycation Tax Credit for the 2022 tax year. Our Ontario Government is offering a temporary Tax Credit for Ontario Residents for 2022.

Anyone planning a getaway within the province in the 2022 tax year could be eligible under the new Ontario Staycation. To help the tourism and hospitality sectors recover and encourage Ontario families to explore the province the government is proposing a new temporary Ontario Staycation Tax Credit for 2022. The Ontario government has announced its plan for a staycation tax credit.

Individual with Significant Control. The government notes eligible accommodations will be stays of. Are you looking for an extra special getaway this season.

Extension of the Ontario Seniors Home Safety Tax Credit. The organization looked at food bank visits starting in April 2020 to the end of March 2021. The government proposal was announced on Thursday as part of the 2021 Ontario Economic Outlook and Fiscal Review.

Introducing the Ontario Staycation Tax Credit. This Personal Income Tax PIT credit would provide Ontario residents with support of 20 per cent of eligible 2022 accommodation expenses of up to 1000 for an individual and 2000 for a family for a maximum credit of 200 or 400. Ontario Staycation Tax Credit.

The tax credit is a government initiative to help the tourism industry recover by encouraging the residents to explore their home province ON. These credits are combined and paid as the Ontario Trillium Benefit. We are a Pet Friendly Lodge.

Earlier in November the Ontario government proposed a brand new temporary Ontario Staycation Tax Credit for the year 2022. Ontario Energy and Property Tax Credit. Political Contribution Tax Credit.

Ontario S Staycation Tax Credit Could Give You Money Back For Travelling In The Province In 2021 The Province Staycation Ontario

Ontario Announces Plan For Staycation Tax Credit And Here S How It Works R Ontario

Oginject Legit Dec 2021 All You Need To Know

Ontario S Staycation Tax Credit Could Give You Money Back For Travelling In The Province In 2021 The Province Staycation Ontario

Staycation Report 2021 Staycations Set To Stay As The Continued Travel Trend For 2022 Traveldailynews International

Staycation Report 2021 Staycations Set To Stay As The Continued Travel Trend For 2022 Traveldailynews International

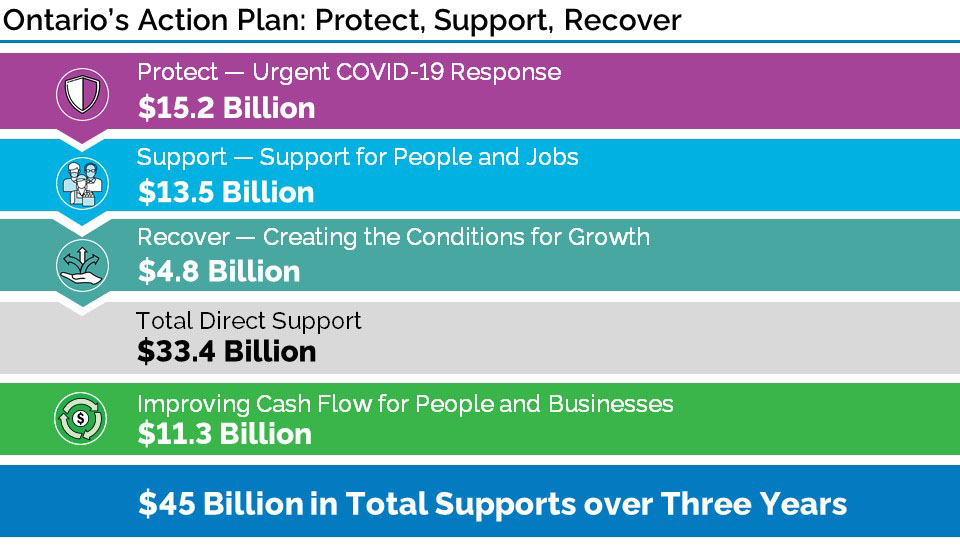

2020 Ontario Budget Introduction

Ontario S Staycation Tax Credit Could Give You Money Back For Travelling In The Province In 2021 The Province Staycation Ontario

Lj Business Solutions Home Facebook

100 000 Point Sign Up Bonus On The Chase Marriott Card Travelupdate

Ontario S Mega Virtual Rv Show Sicard Rv